The essential overview of hotel dynamic pricing (price tags)

Smart hoteliers view revenue management as a strategic way to improve profits. One component is “dynamic pricing.” You’re familiar with this model when considering your rack rate vs. your bottom prices. Those bottom prices may not cover much more than your costs, but they impact your rack rate months away when you can see higher profits. You’ll see below how this works.

Wading into the revenue management waters requires learning a few new concepts. Or, maybe they’re not new to you, but you’re going to think of them differently.

First, consider your hotel has a pricing path. This path has different phases throughout the year. For example, your low season vs. high season rates are different. Through your revenue management lens, you’ll want to chart your property’s pricing plan. Your goal is to maximize revenues or reduce damages.

Below, you can see a graph we’ll call “price tags.” You can see there are six columns each reflecting a different sales phase. We’ll define these terms in the rest of the article and offer examples for each.

Wading into the revenue management waters requires learning a few new concepts. Or, maybe they’re not new to you, but you’re going to think of them differently.

First, consider your hotel has a pricing path. This path has different phases throughout the year. For example, your low season vs. high season rates are different. Through your revenue management lens, you’ll want to chart your property’s pricing plan. Your goal is to maximize revenues or reduce damages.

Below, you can see a graph we’ll call “price tags.” You can see there are six columns each reflecting a different sales phase. We’ll define these terms in the rest of the article and offer examples for each.

What are the bottom and starting prices?

Let’s start with these two types of hotel dynamic pricing. Bottom and starting prices might sound similar, but they have different nuances.

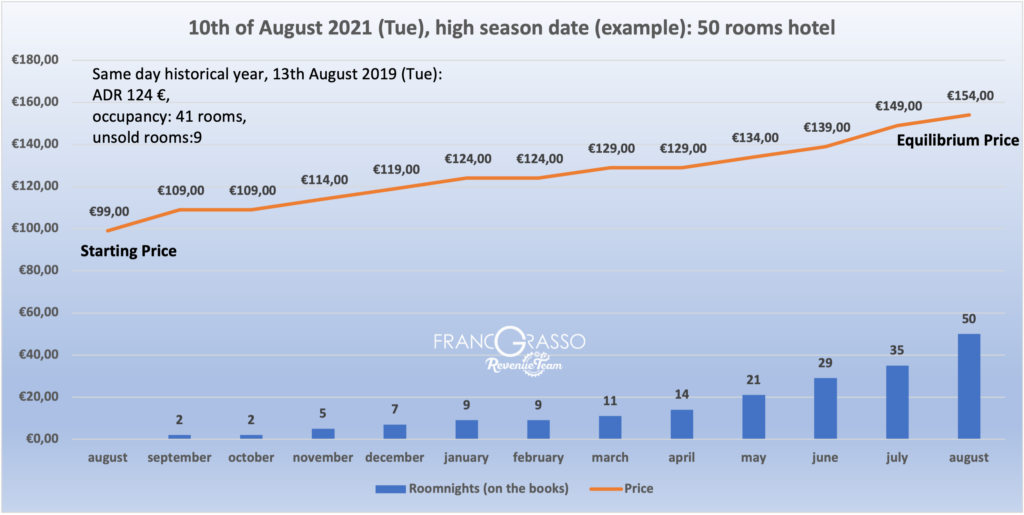

The starting price objective is different and based on the property’s rate history. The main goal is to sell the rooms that remained unsold same day previous year. The distance between the starting price and historical ADR (average daily rate) is proportional to the number of unsold rooms. The higher the unsold rooms volume, the lower the starting price. The lower the volume of unsold rooms, the higher the starting price.

This starting price can coincide with the bottom rate when the historical data indicate a great amount of empty rooms

Here’s an example of this approach.

The bottom rate is the minimum selling rate. There are three reasons why your hotel won’t go below this rate:

1) Economic limits (costs would exceed revenues and there would be a loss)

2) Psychological/brand limits (resistance to accepting to fall below a certain subjective price threshold)

3) Legal (imposition of local authorities)

The bottom rate includes variable costs, and these only affect occupied rooms. If you want an overview of fixed and variable costs and calculating them, you can consult this article from Franco Grasso Revenue Team

It’s fundamental to define the bottom rate for the hotel room. Once you’ve determined the bottom rate, your revenue manager can adjust the pricing. For example, what if you have a high volume of unsold rooms and you’d like to fill them yet still cover your costs? That’s where knowing your bottom rate comes in.

Here’s the breakdown.

Bottom rate pricing does two things.

- It increases visibility throughout the year by combining a competitive rate with a great value to generate positive reviews.

- It stimulates demand at weak times of the year.

A core element of dynamic pricing is excellent reviews for your property. Great reviews boost the hotel’s visibility during high season. That way, more people book at higher rates during the busier times of the year.

Are you starting to see how a correct bottom price in the low season can impact the entire revenue management cycle? Here’s an example, let’s say your hotel has a $59 bottom rate in low season. Because you’ve implemented revenue management principles, you know that the bottom rate covers costs. Then, because your guests are so happy with the value, they rave about you online. When high season comes around again, you’re able to sell the same room for $599.

With the bottom price decided, you can look at the starting price.

What’s the starting price?

You want to apply rates to your rooms at least a year in advance, as this will allow you to build your base of online visits, reservations, occupancy rate and develop your pricing dynamism at the proper time. When potential guests see the advertised rates, that anchors the rate in their minds.

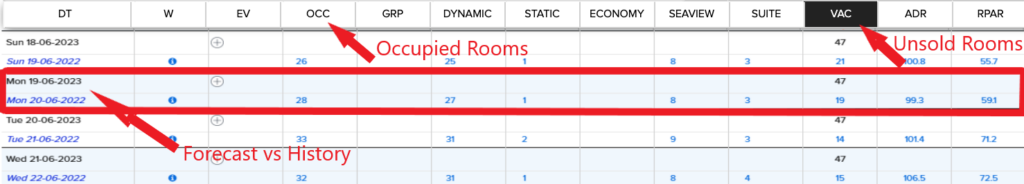

You need historical data to determine the starting price. Usually, you look at the previous year and compare days. For instance, if you’re comparing Monday, Jun. 19, 2023, you want to compare the third Monday of Jun. 2022.

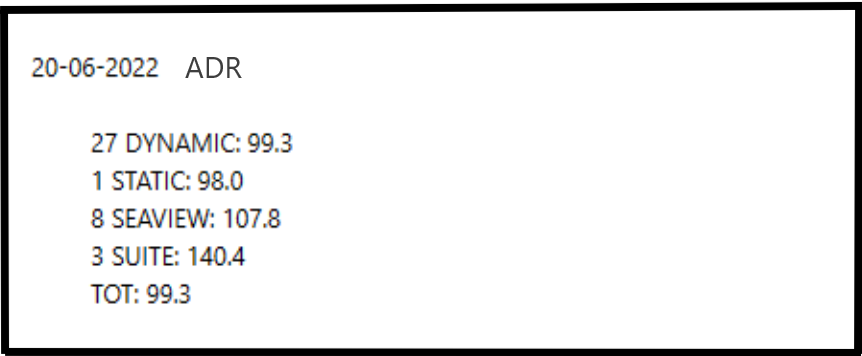

How many rooms were full in your hotel on that day? How much did people pay for them? What about the pickup and average rate per room when comparing channels and markets? As you know, some markets are dynamic like OTAs (free sale and dynamic pricing), and others are static like tour operators (allotments and negotiated flat rates). This analysis goes deeper too. Your revenue management system can share this data with you, and it’ll also give you the data on unsold rooms volume and Revpar.

Armed with this level of detail, you can assess the starting price for specific room types and per channel.

The historical data will give you the information you need to decide a starting price for your room rate. If you had a lot of unsold rooms last year, you might want to lower the starting price. It should always relate to the number of unsold rooms.

Covid and historical data

Covid has made historical data a more articulated and complex concept. Some analysts argue that Covid has eliminated the importance of historical data.

Stating that historical data has lost relevance is equivalent to saying that revenue management itself has lost relevance. Its essence is analyzing the past to predict the future and maximize profits.

And when the previous year seems to be useless to be compared for any negative or positive reason, it makes sense to use the most relevant historical year ever as your reference, even if it’s 2 or 3 years behind.

Of course, for a new property without historical data, the wisest thing to do would be to monitor the local market performances to get an idea of how to position itself at the beginning. Then applying a starting price as low as possible (covering variable costs of course) in line with each period and season.

Be cautious of course with the inventory distribution and ready to increase prices as the pick-up, demand and lead time would indicate.

This way you’re going to build your history on the way and use it as a baseline for future years.

Other historical variables

Of course, other parameters inform your starting price.

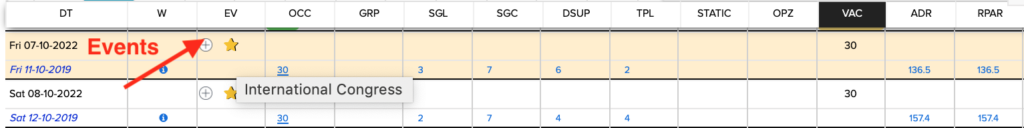

1) Special events – The Olympics, regional sporting events, concerts, large trade shows

2) Market trends (Is the local tourism bureau doing a big push for your destination?)

3) Property specific (Splashy campaigns, enhanced property ranking online.)

Each of these situations plays into your starting rate. For example, let’s say your property has a 100% occupancy rate on a specific date. It is wise to price the room a little lower than the historical ADR (average daily rate) shows. From there, you can use dynamic pricing that aligns with demand trends and make year on year incremental revenue.

Yet, that’s not the only way. There are cases where it makes sense to set your starting prices above the historical ADR. Perhaps you know there’ll be a high demand at a specific time of year, though the historical data is not apparent.

There can be many reasons. For example, do any of these sound familiar?

1) A group that came every year in the past but booked in at an insufficient rate for some reason. It affects the historical ADR. If that group is not coming this year, you can benefit from higher starting prices on dynamic channels

2) The destination enjoys greater visibility due to the World Cup or other events.

3) Major infrastructures such as a new airport or roadways

4) Other significant events or tourism board campaign

5) In some cases, the property’s online visibility increases yearly.

Dynamic pricing is part of revenue management. Together, the elements boost online conversions for hotels. Then, as a result of higher conversions, the search engine algorithms notice. The result is your property enjoys a higher search ranking resulting in more visibility and bookings.

This is not accidental but rather a shrewd calculation. When your property has high visibility, you can adopt higher starting prices.

It may sound like a lot of work to develop the optimal starting price, yet, it’s worth it. Some medium and small hotels have found doing this work improves their results by up to 60%.

Of course, developing the starting price is only the foundation. Once it’s in place, you can review your hotel’s dynamic pricing with a revenue manager’s eye. Keep in mind, dynamic doesn’t mean you have to move prices for every day of the year for the sake of being “dynamic”. This means there may be weak times when your bottom/starting price remains flat right up to the arrival date and should never change all the way through.

How Revenue Managers can incorporate dynamic pricing

As you can see, dynamic pricing includes many variables, and some of them are more predictable than others. The more you’re in tune with the market, the more you can improve your profitability.

You’ll want to recognize:

1) Historical variables

2) Forecast variables

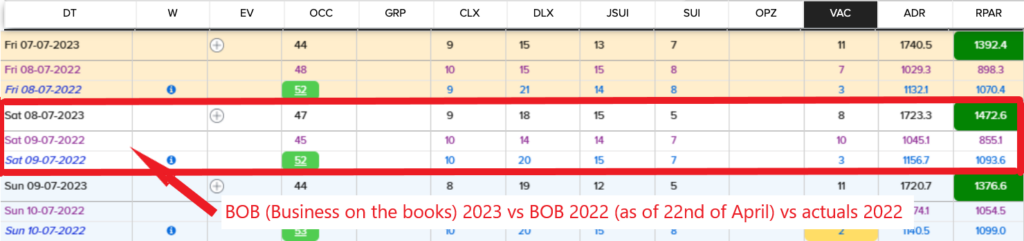

The baseline for analyzing a date is to ask, “what was the situation last year on the same date as this year?”

By comparing specific dates a year apart, you can understand how the hotel performs today and in the months ahead.

Questions like:

1) How many rooms were occupied?

2) At what rates?

3) Via which channels?

You’ll also ask yourself if your rooms are booking faster or slower and why. Basically you’re going to do a BOB (business on the books) comparison between this year and last year. Is your brand reputation improving or not? Are you getting more positive reviews and thus seeing higher rankings? Are there local or world events impacting your destination?

Once you assess those scenarios, you’ll consider if it makes sense to raise rates or stay the course? What else could affect the rates?

Yes, you can do this analysis pre-covid if you like. That way, you remove an outlier.

All the variables contribute to three factors: pickups, how much lead time you have, and sales channels.

Pickups and booking window

Pickups refer to the number of rooms your property sells daily or weekly for a given date in the future. What type of room is it, what’s the room rate, and what’s the date?

Revenue managers will consider when to raise the rates and by how much? Should you increase them a small amount or a larger amount? You’ll consider the other variables such as distance to the date (the amount of time we have to sell all the rooms) and sales channels to discover the optimum rate.

Here’s an example, imagine selling ten rooms over ten months for a specific day. That requires a different pricing strategy than selling ten rooms for the same day over ten days.

Then, you have other situations. For example, some hotels sell rooms at a negotiated flat rate to a group, and that’s a different approach than selling those same rooms online with dynamic pricing.

Here are three considerations to help you decide your pricing.

1. In the past, how many rooms have sold for different price points such as $99, $109, $119?

2. On which channels?

3. How long in advance?

4. What’s the average booking window for your guests?

You can better assess your peak booking times and your slower times to gauge these inputs. The average booking window changes depending on the destination, and it can range between 45-10 days for holiday destinations. Cities see more short-haul traffic, and the range can be as little as 20-1 day.

These time frames affect your hotel’s dynamic pricing structure. This brings us to the last three terms you’ll want to know in the dynamic pricing paradigm.

What are the Equilibrium price and resistance price?

To achieve equilibrium is to reach a balance between demand and supply within the average booking window. That way, the hotel can fill the rooms and accomplish the most profitability without risk. One way hotels do this is to have total occupancy at a higher ADR than the previous year, and a higher ADR usually increases turnover.

When analyzing past data and comparing it with market trends and your typical pickups, you can pinpoint the best equilibrium rate.

Now, there can be outside variables that affect your equilibrium rate and lead to a slowdown. Let’s say your hotel sees a trickle of reservations when there has been a brisk pace, or you find yourself processing cancellations. We call that the resistance price, and you’ll want to reassess.

The reasons the resistance price pops up can be for many reasons.

- Price goes up too fast or too much

- Brand reputation suffers

- Lousy weather threatens

- Event cancellations

- Economic crisis

- Even other hotels pricing structures can affect your market.

When you’re looking for a way around the resistance price, you’ll still want to get the best rate you can. You may find yourself offering a last-minute discount rate. Of course, for this to be successful, you’ll want to structure it in a way that prevents guests from canceling and rebooking at a lower rate.

You’ll assess the number of empty rooms, how much lead time you have and your average booking window. This analysis will guide you to your next pricing option. The best pricing for your situation could be returning to the equilibrium price. Or, in the case of serious miscalculation, it might mean returning to the bottom rate.

Finding the correct ratio between equilibrium and resistance pricing is a complex task, and it’s also one of the most exciting in the revenue management world. Usually, you can find a connection between these ratios and the attitude of the revenue manager.

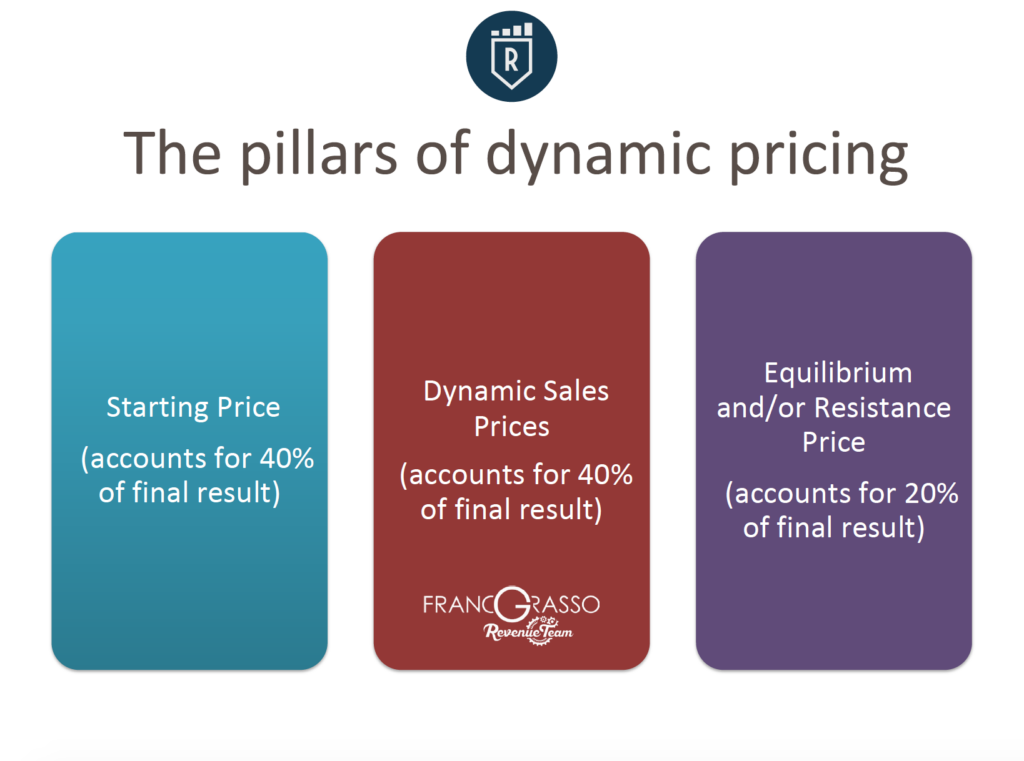

You can identify three pillars of dynamic pricing as follows:

Sometimes dynamic pricing reaches the highest rates called the rack rate.

The rack rate is the highest

Often found on the backs of hotel room doors due to local regulations, the rack rate signals an occasional rate. For example, guests may pay the rack rate at holidays or significant events at the destination.

Besides the highest rate, it can also keep the property visible online even if fully booked. You know there’s the possibility of cancellations. So if you overbook a few rooms, you can rebook them when you have those cancellations.

If your analysis shows your guests book your rack rate often, then it may be too low, and it’s not meant to be your “typical” rate.

As you can see, revenue management is a complex discipline, and it requires strategic thinking and data access. Your Revenue Management System (RMS) can help you automate many necessary calculations.

Of course, a human must provide the thinking part of this job. You can hire an in-house revenue manager or outsource it, and either way, this person coordinates the best strategy and execution for profitable results.

Your RMS software and human revenue manager can guide you on the distribution channels, cancellation policies, and much more. The hoteliers and revenue managers of the Franco Grasso Revenue Team have developed an excellent RMS. This software ensures you have the relevant data to inform your revenue pricing strategy.

With the right inputs, the software can define the bottom rates, starting rates, etc., for every day of the year. Then, share it as relevant.

Now that you understand dynamic pricing better, you can understand the complexity and potential profits.

As you can see, dynamic pricing or “price tags” is a complex yet profitable avenue to greater hotel profitability. It starts with the right data inputs to determine the correct base bottom and starting prices. Once you have those, you can adjust for other factors. An experienced revenue manager interprets the data and uses it to make your pricing decisions.

If you have questions or need additional information, Franco Grasso Revenue Team can help.

Download these ebooks for free:

10 things to know about revenue management

5 revenue tips for city, beach, mountain, countryside hotels